cash flow diagram example problems

This is an example of a cash flow in and out diagram for 5 years the X-axis represents the time scale. Enhancing the Cash Flow Diagram.

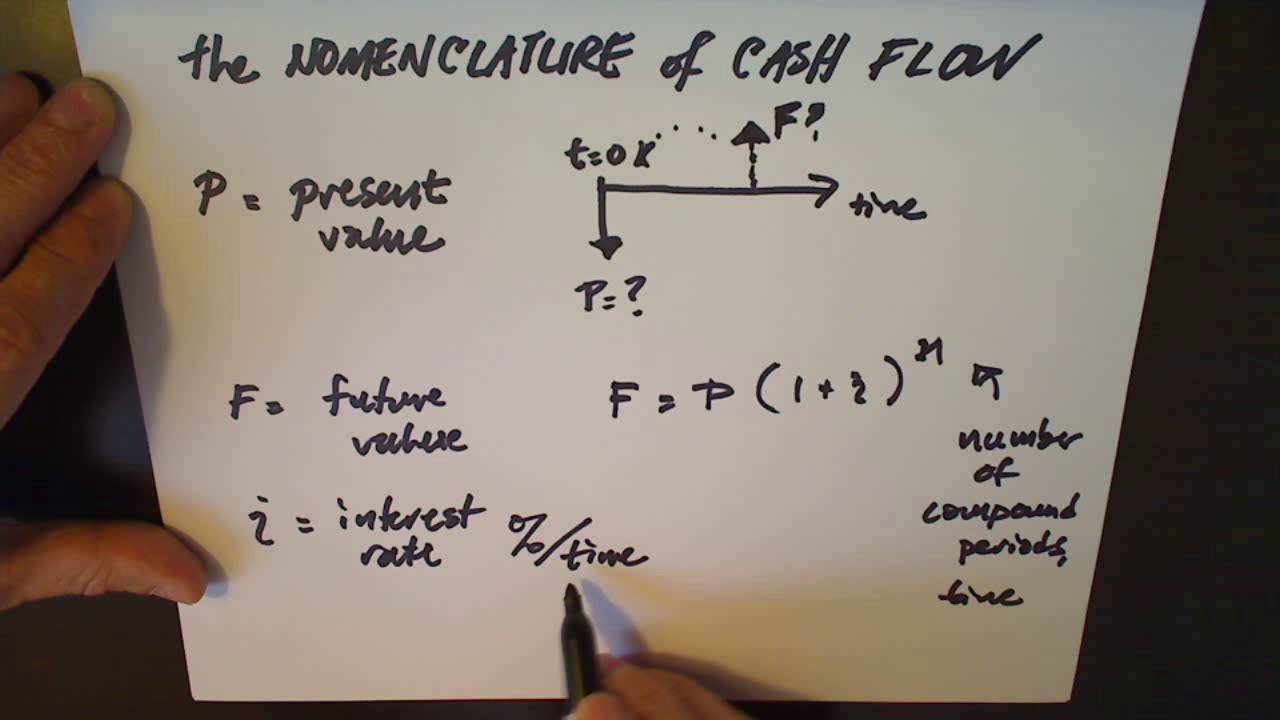

F PFP i n This formula can be used to calculate the compounded interest on a single payment.

. Here is a compilation of top nine problems on cash flow statements along with its relevant solutions. From our Simple Interest Example. After taking the following information in to account prepare a cash flow statement for the year ending 31122007 1.

This video describes a simple example problem in engineering finance relating present and future value for a arithmetic gradient series. From the following summary of Cash Account of X Ltd prepare Cash Flow Statement for the year ended 31st March 2007 in accordance with AS-3 using the direct method. An example for cash flow in and out diagram.

Single-Payment Compound-Amount Formula. Here is a compilation of top three accounting problems on cash flow statement with its relevant solutions. It will need to have its engine rebuilt in 6 years for a cost of 22000 and it will be sold at year 9 for 6000.

It will cost 9500 each year to operate including fuel and maintenance. Adjust Non-Cash Expenses that are already deducted from the Accounting Net Profit. The following conventions are used to standardize cash flow diagrams.

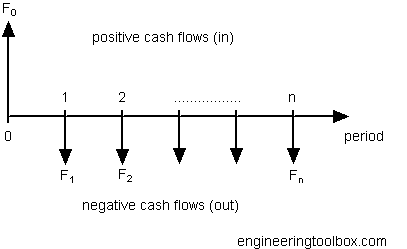

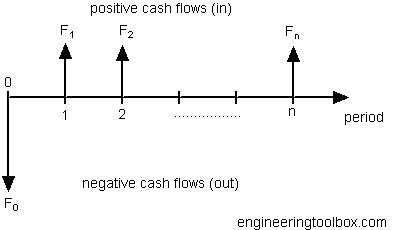

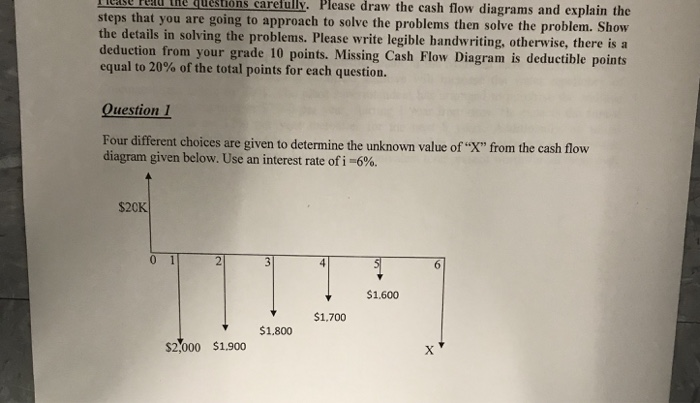

Problems cash flow diagrams can be drawn to help visualize and simplify problems that have diverse receipts and disbursements. Upward arrows - positive cash flow receiving the loan downward arrows - negative cash flow pay off The Present Value of the cash flows can be calculated by multiplying. The interval from 0 to 1 represents the first year period and from 1 to 2 represents the second year and from 2 to 3 represents the third year.

See the textbook Civ. The profit for 20062007 was Rs8600 against this had been charged Dep. For small businesses Cash Flow from Investing Activities usually wont make up the majority of cash flow for your company.

For example consider a truck that is going to be purchased for 55000. It tells how much a certain investment earning compound interest will be worth in the future. We will use them in many of our problems.

Cash Flow Diagram - Loan Transaction. 3050 and increase in provision for doubtful debt Rs200 2. In the above question the Net Profit of the firm is 800000.

2500 1500 S1800 15 Years b F-1 i-8 compounded annually A-1000 10 Years c. Here is the cash flow diagram. There are many types of CF with various important uses for running a business and performing financial analysis.

Now that we know how to draw cash flows we can embellish our diagram to make it more useful. In general we want to add labels to our diagram but only to the point that they are helpful. Having excess or incomplete inventory is one of the typical cash flow example problems and solutions like having good inventory management will not only help in avoiding being out of stock or overstocked but also in keeping track of the companys overall sales.

The axis is divided into 5 equal spaces from 0 to 5. Cash Flow from operation considers only the cash Inflow and outflow from the daily operation of the company. But it still needs to be reconciled since it affects your working capital.

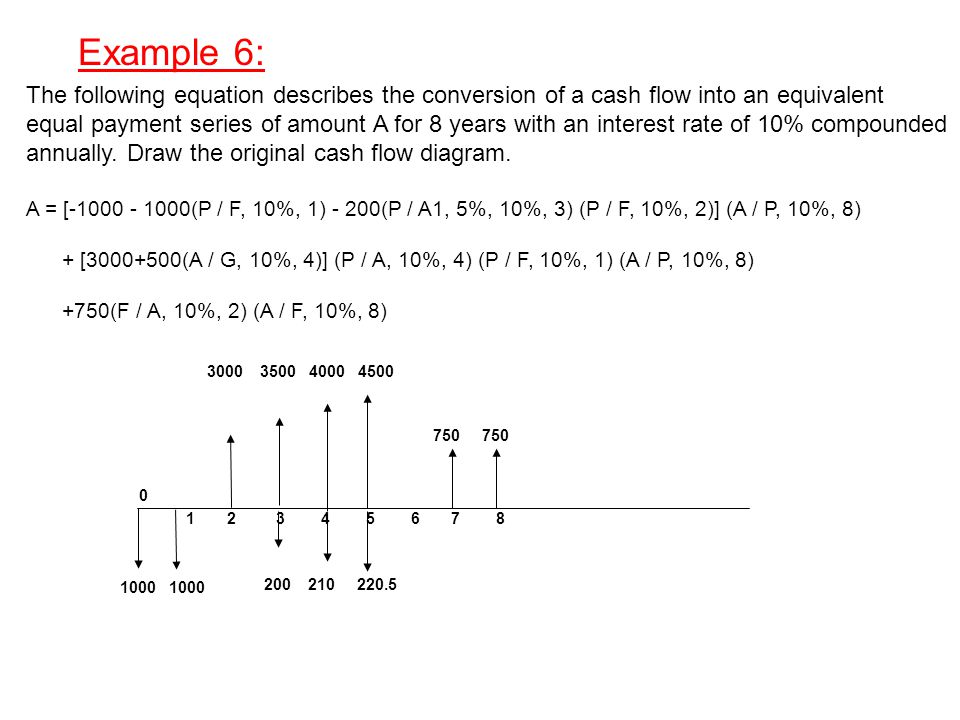

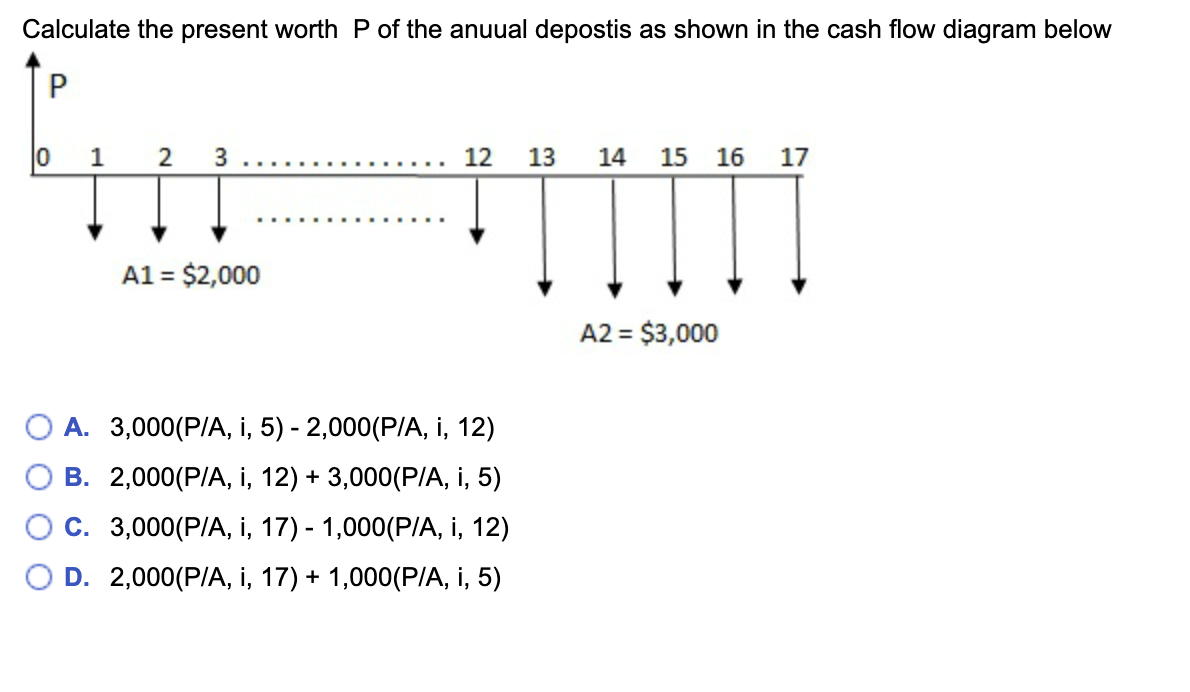

Solving Cash Flow Diagram Problems Find the value indicated by using Table Notation Table notation example. The horizontal time axis is marked off in equal increments one per period up to the duration of the project. Just as with auxiliary tables Cash flow diagrams can be split into separate equivalent diagrams.

Every Cash flow diagram contains the following components. Time line -- with discrete periods Cash flow vectors -- Up Inflow Benefit or -- Down - Outflow Cost Interest rate. Keep in mind that the purpose of the diagram is to illustrate a complex financial transacation as concisely as possible.

We will begin by defining Cash Flow discuss the g. Cash Flow CF is the increase or decrease in the amount of money a business institution or individual has. Cash Flow from Investing Activities in our example.

The company does not have any cash equivalents. P-FPF i n-Fvalue from table -result a F-1 1-6 compounded annually F-. Start from the Accounting Net Profit of the Firm.

Cash flow diagram. A loan transaction starts with a positive cash flow when the loan is received - and continuous with negative cash flows for the pay offs. During the same period it issued shares of Rs200000 and redeemed debentures of Rs150000.

Purchase of Equipment is recorded as a new 5000 asset on our income statement. In finance the term is used to describe the amount of cash currency that is generated or consumed in a given time period. The bank balance of a business firm has increased during the last financial year by Rs150000.

Example You are considering a project that will require a 300000 investment.

Cash Flow Diagrams Present Or Future Value Of Several Cash Flows Engineering Economics Youtube

Example 1 In The Following Cash Flow Diagram A8 A9 A10 A11 5000 And Ppt Video Online Download

4 Easy Illustration For Cash Flow In And Out Diagram

Example 1 In The Following Cash Flow Diagram A8 A9 A10 A11 5000 And Ppt Video Online Download

Solved Refer To The Cash Flow Diagram What Is The Present Chegg Com

Engineering Economic Analysis Cash Flow Diagram Youtube

Solved Question The Cash Flow Diagram Of A 12 Months Chegg Com

Cash Flows Compound Interest Cash Flow Inflow Outflow Of Money

Understanding Cash Flow Diagrams Present And Future Value Youtube

Cash Flows Compound Interest Cash Flow Inflow Outflow Of Money

Solved Nelesions Caretully Please Draw The Cash Flow Chegg Com